rhode island tax table 2019

Find your income exemptions. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

March Madness 2019 Real Estate Edition March Madness College Basketball Teams Real Estate

2019 Forms W-2 filing reminders.

. Assessment Date December 31 2019 CLASSES. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Find your gross income.

Check the 2019 Rhode Island state tax rate and the rules to calculate state income tax. Read the Rhode Island income tax tables for Single filers published inside the Form 1040 Instructions booklet for more information. 2019 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. This form is for income earned in tax year 2021 with tax returns due in April 2022. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599.

Year Ending 12312016. The 2019 Form RI W-4 which the employer is required to keep on file is included in the 2019 employer withholding booklet and available separately here. Tax rate of 375 on the first 65250 of taxable income.

Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages. The state sales tax rate in Rhode Island is 7 but. 2022 Rhode Island Sales Tax Table.

2020 Rhode Island Tax Deduction Amounts. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

CYE 2019 Partnership Income Tax Return to be filed by LLCs LLPs LPs and Partnerships. The Rhode Island 1040 instructions and the most commonly filed individual income tax forms are listed below on this page. Detailed Rhode Island state income tax rates and brackets are available on.

The steps in computing the income tax to be withheld are as follows. Rhode Island Division of Taxation. Personal Income Tax Tables PDF file less than 1 mb megabytes.

Tax rate of 375 on the first 65250 of taxable income. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. One Capitol Hill Providence RI 02908.

Employees must require employees submit state Form RI W-4 if hired in 2020 or when making withholding tax changes in 2020. Of the on amount Over But Not Over Pay Excess over 0 66200 375 0 Use for all filing status types TAX If Taxable Income- Subtract d from c RI-1040. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022.

Tax rate of 599 on taxable income over 148350. The income tax is progressive tax with rates ranging from 375 up to 599. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Rhode Island 2020 income tax withholding tables available. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island. For married taxpayers living and working in the state of Rhode Island. The Rhode Island Department of Revenue is responsible for.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Tax rate of 475 on taxable income between 65251 and 148350. More about the Rhode Island Tax Tables.

FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. However if Annual wages are more than 231500 Exemption is 0.

The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island.

New employees must submit Form RI W-4. Divide the annual Rhode Island tax withholding by 26 to obtain the. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

The state income tax table can be found inside the Rhode Island 1040 instructions booklet. How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1.

How to Calculate 2021 Rhode Island. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. Rhode Island annual income tax withholding tables percentage method for wages paid on or after January 1 2019.

Resident Individual Income Tax Return including RI Schedule W - Rhode Island W-2 and 1099 Information and Schedule E - Exemption Schedule PDF file about 5 mb megabytes. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Rhode Island Bank Deposits Tax.

Find your pretax deductions including 401K flexible account contributions. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

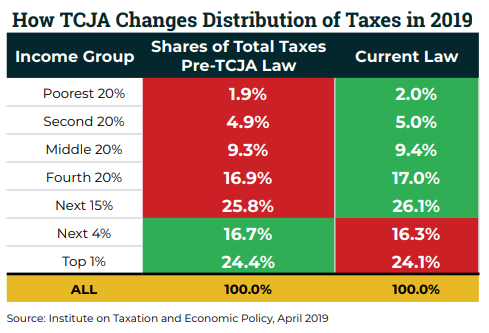

Who Pays Taxes In America In 2019 Itep

State Of Connecticut Connecticut Student Loan Forgiveness Seal

County Surcharge On General Excise And Use Tax Department Of Taxation

Spokane Community College Christmas Break Dates 2021 Community College Public School School Calendar

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Division Of Taxation 2019

Property Taxes Account For 40 Percent Of State And Local Tax Revenue In Q1 2019 Eye On Housing

Find Craft Shows In Rhode Island 2019 2020 Festivalnet Com Island Crafts Island Crafts

Get Our Image Of First B Notice Form Template Templates Powerpoint Presentation One

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep